Drivers Kamstrup A/s

Smart Water Metering Market by Type (Automated Meter Reading [AMR] and Advanced Metering Infrastructure [AMI]), Component (Endpoint Hardware, Network Infrastructure, and Installation), and Region (Americas, Europe, Asia Pacific, and Middle East & Africa) - Global Forecast to 2025

- June, 2019

- Domain: Electronics & Semiconductors-Electronics & Semiconductors

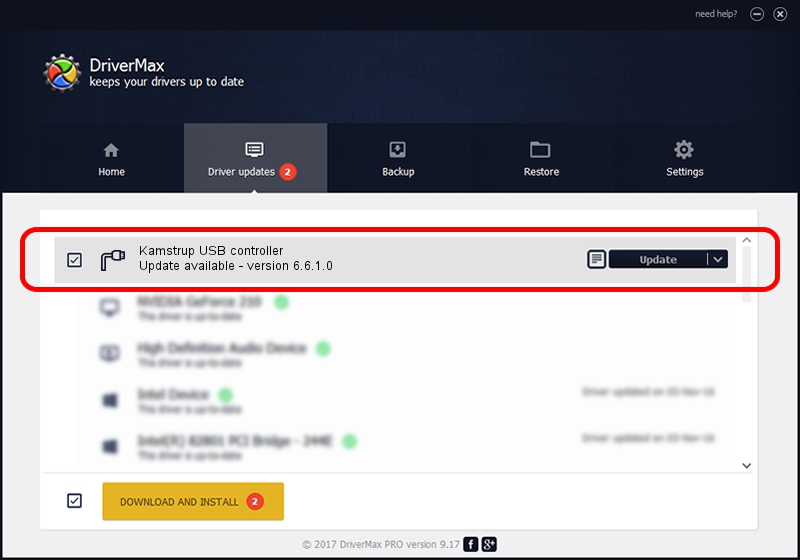

- Software for Kamstrup USB interface. For Windows 98/2000/2003 and Windows XP (without Service Pack 3) Download: Driver (5098282, Rev. D1) for Kamstrup USB Interface (optcal/3-wire) zip-fil (15 MB).

- Kamstrup is world leading manufacturer of system solutions for smart energy and water metering. Through our leadership, expertise and passion for partnership, we always think forward in pursuit of a brighter energy future; one that advances the performance of every customer, whilst creating lasting value for the communities they serve.

The driver can be downloaded from www.kamstrup.com Downloads Driver for Kamstrup USB. 11.4.2 Data + pulse outputs (type no. HC-003-11) The module has a galvanically separated data port that interoperates with the KMP protocol (see paragraph 12.2). Software for Kamstrup USB interface is a free program that contains all the drivers necessary for the Kamstrup USB to be installed on a computer. The program includes the Windows 98SE, 2000, 2003, XP, Vista and 7drivers for the Kamstrup USB, allowing you to install only the one for your computer system.

- Get Free 10% Customization in this Report

COVID - 19

Covid impact updated reports at special price

Inquire NowThe study on “global smart water metering market” details the market size and analysis across various segments, which include Type (Automated Meter Reading [AMR] and Advanced Metering Infrastructure [AMI]); Component (Endpoint Hardware, Network Infrastructure, Installation, and Others); and Region (Americas, Europe, Asia Pacific, and Middle East & Africa).Smart Water Metering Market Overview:

The global smart water metering market is anticipated to witness significant growth during the forecast period. In recent years, the demand for water has increased significantly due to climate changes and other factors such as increasing population and rapid urbanization. As a result, governments across countries are heavily focusing on developing frameworks related to water management policies and a comprehensive strategy for long-term water resource management. This has pressurized water utilities to reduce water losses from both an environmental and financial standpoint.

Currently, the technology development and adoption of advanced technologies, such as IoT and analytics, in the water sector is lagging when compared to other utilities such as electricity and gas. Moreover, water systems in many countries are running on aged infrastructure, and technologies that utilities rely on managing water are largely outdated, which has resulted in increased non-revenue water (NRW).

Governments and utilities are emphasizing on reducing non-revenue water, and transformation of aging water infrastructure with growing focus on developing sustainable water infrastructure. The market will witness demand for water metering solutions that can be integrated with smart communicating devices, as rising focus on reducing the operating cost driving the global smart water metering market. Emerging low power IoT connectivity technologies (NB-IoT) allow utilities to eliminate the need for investing in establishing their own communication infrastructure for remote meter reading, a prominent trend likely to accelerate the growth of the global smart water metering market during the forecast period. Additionally, increasing smart city initiatives and expanding urban landscape in developing economies are identified as opportunities anticipated to fuel the growth of the smart water metering market during the forecast period 2019–2025.

Additionally, utilities operating in developed economies are mandated to meet certain guidelines and standards to eliminate the commercial loss – water that is incorrectly billed because of poor/incorrect metering and physical loss – leaks and theft from the water distribution system, which is further accelerating the growth of the smart water metering market. Moreover, advancement in IoT and sensing technologies, declining deployment cost of IoT solutions, and increasing focus on utilizing data-driven solutions to improve operating revenue of utilities are further fuelling the growth of smart water metering market.

Market Revenue and Segmentation Analysis Smart Water Metering Market

The global smart water metering market is anticipated to grow at a CAGR of 13.3% during the forecast period 2019–2025.

Drivers Kamstrup A/s Tires

The global smart water metering market is segmented based on type, component, and region. In terms of type, the global smart water metering market is sub-segmented into automated meter reading (AMR) and advanced metering infrastructure (AMI). The AMR segment dominated in 2018 and is expected to lose its market share to the AMI segment during the forecast period. This is primarily due to higher operating costs of AMR when compared to AMI since meter readers must still drive the routes. The AMI system offers various water management capabilities such as enhanced tracking of flow patterns and water consumption, ability to monitor changes in demands and trends, and abnormalities in distribution network among others. By type, AMI is anticipated to be the fastest growing segment attributed to its advanced water management capabilities of AMI system and increasing interest on smart grid solutions. In terms of component, the global smart water metering market is sub-segmented into endpoint hardware, network infrastructure, installation, and others.Regional Analysis

In 2018, the Americas was the dominant region in the global smart water metering market followed by Europe. Asia Pacific is identified as the fastest growing region in the global smart water metering market, i.e., growing at a CAGR of 20.8% during the forecast period 2019–2025. This is mainly due to rapid urbanization and expanding urban landscape along with increasing investment in smart city initiatives.

Benefits and Vendors

The report on smart water metering market contains an in-depth analysis of vendors, which includes financial health, business units, key business priorities, SWOT, strategies, and views; and competitive landscape. Few of the key players profiled in this study include Xylem Inc. (Sensus), Itron Inc., Badger Meter, Inc., Kamstrup A/S, Landis+Gyr., Neptune Technology Group, Arad Group, Diehl Stiftung & Co. KG, Hubbell (Aclara Technologies LLC), and Mueller Water Products, Inc.

The report on smart water metering market contains an in-depth analysis of vendors, which includes financial health, business units, key business priorities, SWOT, strategies, and views; and competitive landscape. Few of the key players profiled in this study include Xylem Inc. (Sensus), Itron Inc., Badger Meter, Inc., Kamstrup A/S, Landis+Gyr., Neptune Technology Group, Arad Group, Diehl Stiftung & Co. KG, Hubbell (Aclara Technologies LLC), and Mueller Water Products, Inc.The study offers a comprehensive analysis of the “global smart water metering market”. Bringing out the complete key insights of the industry, the report aims to provide an insight into the latest trends, current market scenario, and technologies related to the market. In addition, it helps the venture capitalists to understand revenue opportunities across different segments to take better decisions.

Key Segments of the Report Include:

- Automated Meter Reading (AMR)

- Network Infrastructure

- Others

- Americas

- Asia Pacific

1 Executive Summary

2 Industry Outlook

2.1 Industry Overview

2.1.1 Industry Trend

2.1.1.1 Emerging low power IoT connectivity technologies (NB-IoT)

3 Market Snapshot

3.1 Overview

3.1.1 PEST Analysis

3.1.2 Porter’s Five Force Analysis

3.2 Related Markets

4 Market Characteristics

4.1 Market Distribution Structure

4.2 Market Developments

4.3 Market Segmentation

4.4 Market Dynamics

4.4.1 Drivers

4.4.1.1 Increasing importance of reducing Non-Revenue Water

4.4.1.2 Transformation of aging water infrastructure with smart devices for resource sustainability

4.4.1.3 Utilities pressurized to reduce operating cost

4.4.2 Restraints

4.4.2.1 Lack of IT knowledge and complexity in integrating with existing infrastructure

4.4.2.2 Lack of political and regulatory support in developing economies

4.4.3 Opportunities

4.4.3.1 Increased focus on water-related smart city initiatives

4.4.3.2 Expanding urban landscape in developing economies

4.4.4 DRO – Impact Analysis

5 Smart Water Metering Market, By Type

5.1 Overview

5.2 Automatic meter reading (AMR)

5.3 Advanced metering infrastructure (AMI)

6 Global Smart Water Metering Market, By Component

6.1 Overview

6.2 Endpoint Hardware

6.3 Network Infrastructure

6.4 Installation

6.5 Others

7 Global Smart Water Metering Market, By Region

7.1 Overview

7.2 Americas

7.2.1 Overview

7.2.2 By Type – Market Size and Analysis

7.2.3 By Component – Market Size and Analysis

7.3 Europe

7.3.1 Overview

7.3.2 By Type – Market Size and Analysis

7.3.3 By Component – Market Size and Analysis

7.4 Asia Pacific

7.4.1 Overview

7.4.2 By Type – Market Size and Analysis

7.4.3 By Component – Market Size and Analysis

7.5 Middle East & Africa (MEA)

7.5.1 Overview

7.5.2 By Product Type – Market Size and Analysis

7.5.3 By Component – Market Size and Analysis

8 Vendor Profiles

8.1 Xylem Inc.(Sensus)

8.1.1 Company Description

8.1.2 Business Analysis

8.1.2.1 Strategic Snapshot

8.1.2.2 Business Impact Analysis

8.1.2.3 Operational Snapshot

8.1.2.4 Product/Service Portfolio

8.2 Itron Inc.

8.2.1 Company Description

8.2.2 Business Analysis

8.2.2.1 Strategic Snapshot

8.2.2.2 Business Impact Analysis

8.2.2.3 Operational Snapshot

8.2.2.4 Product/Service Portfolio

8.3 Badger Meter, Inc.

8.3.1 Company Description

8.3.2 Business Analysis

8.3.2.1 Strategic Snapshot

8.3.2.2 Business Impact Analysis

8.3.2.3 Operational Snapshot

8.3.2.4 Product/Service Portfolio

8.4 Kamstrup A/S

8.4.1 Company Description

8.4.2 Business Analysis

8.4.2.1 Strategic Snapshot

8.4.2.2 Business Impact Analysis

8.4.2.3 Operational Snapshot

8.4.2.4 Product/Service Portfolio

8.5 Landis+Gyr.

8.5.1 Company Description

8.5.2 Business Analysis

8.5.2.1 Strategic Snapshot

8.5.2.2 Business Impact Analysis

8.5.2.3 Operational Snapshot

8.5.2.4 Product/Service Portfolio

9 Companies to Watch for

9.1 Neptune Technology Group Inc

9.1.1 Company Description

9.1.2 Business Analysis

9.1.2.1 Strategic Snapshot

9.1.2.2 Operational Snapshot

9.1.2.3 Product/Service Portfolio

9.2 Arad Group

9.2.1 Company Description

9.2.2 Business Analysis

9.2.2.1 Strategic Snapshot

9.2.2.2 Operational Snapshot

9.2.2.3 Product/Service Portfolio

9.3 Diehl Stiftung & Co. KG

9.3.1 Company Description

9.3.2 Business Analysis

9.3.2.1 Strategic Snapshot

9.3.2.2 Business Impact Analysis

9.3.2.3 Operational Snapshot

9.3.2.4 Product/Service Portfolio

9.4 Hubbell (Aclara Technologies LLC.)

9.4.1 Company Description

9.4.2 Business Analysis

9.4.2.1 Strategic Snapshot

9.4.2.2 Operational Snapshot

9.4.2.3 Product/Service Portfolio

9.5 Mueller Water Products, Inc.

9.5.1 Company Description

9.5.1.1 Product/Service Portfolio

10 Annexure

10.1 Report Scope

10.2 Research Methodology

10.2.1 Data Collation & In-house Estimation

10.2.2 Market Triangulation

10.2.3 Forecasting

10.3 Study Declarations

10.4 Report Assumptions

10.5 Abbreviations

TABLE 1 GLOBAL SMART WATER METERING MARKET VALUE, BY PRODUCT TYPE, 2018–2025 ($MILLION) 26

TABLE 2 GLOBAL SMART WATER METERING MARKET VALUE, BY COMPONENT, 2018–2025 ($MILLION) 30

TABLE 3 SMART WATER METERING MARKET VALUE, BY REGION, 2018–2025 ($MILLION) 35

TABLE 4 AMERICAS SMART WATER METERING MARKET VALUE, BY, 2018–2025 ($MILLION) 37

TABLE 5 AMERICAS SMART WATER METERING MARKET VALUE, BY COMPONENT, 2018–2025 ($MILLION) 37

TABLE 6 EUROPE SMART WATER METERING MARKET VALUE, BY TYPE, 2018–2025 ($MILLION) 39

TABLE 7 EUROPE SMART WATER METERING MARKET VALUE, BY COMPONENT, 2018–2025 ($MILLION) 40

TABLE 8 ASIA PACIFIC SMART WATER METERING MARKET VALUE, BY TYPE, 2018–2025 ($MILLION) 42

TABLE 9 ASIA PACIFIC SMART WATER METERING MARKET VALUE, BY COMPONENT, 2018–2025 ($MILLION) 43

TABLE 10 MEA SMART WATER METERING MARKET VALUE, BY PRODUCT TYPE, 2017–2024 ($MILLION) 45

TABLE 11 MEA SMART WATER METERING MARKET VALUE, BY COMPONENT, 2018–2025 ($MILLION) 46

TABLE 12 XYLEM INC.(SENSUS): OVERVIEW 48

TABLE 13 XYLEM INC.(SENSUS):: STRATEGIC SNAPSHOT 49

TABLE 14 XYLEM INC.(SENSUS):: BUSINESS OPPORTUNITIES AND OUTLOOK 49

TABLE 15 XYLEM INC.(SENSUS):: OPERATIONAL SNAPSHOT 50

TABLE 16 XYLEM INC.(SENSUS):: PRODUCT/SERVICE PORTFOLIO 50

TABLE 17 ITRON INC.: OVERVIEW 50

TABLE 18 ITRON INC:: STRATEGIC SNAPSHOT 51

TABLE 19 ITRON INC.: BUSINESS OPPORTUNITIES AND OUTLOOK 52

TABLE 20 ITRON INC.(SENSUS):: OPERATIONAL SNAPSHOT 52

TABLE 21 ITRON INC.(SENSUS):: PRODUCT/SERVICE PORTFOLIO 52

TABLE 22 BADGER METER, INC.: OVERVIEW 52

TABLE 23 BADGER METER, INC. STRATEGIC SNAPSHOT 53

TABLE 24 BADGER METER, INC.: BUSINESS OPPORTUNITIES AND OUTLOOK 54

TABLE 25 BADGER METER, INC.: OPERATIONAL SNAPSHOT 55

TABLE 26 BADGER METER, INC.: PRODUCT/SERVICE PORTFOLIO 55

TABLE 27 KAMSTRUP A/S OVERVIEW 55

TABLE 28 KAMSTRUP A/S: STRATEGIC SNAPSHOT 56

TABLE 29 KAMSTRUP A/S: BUSINESS OPPORTUNITIES AND OUTLOOK 56

TABLE 30 KAMSTRUP A/S OPERATIONAL SNAPSHOT 57

TABLE 31 KAMSTRUP A/S PRODUCT/SERVICE PORTFOLIO 57

TABLE 32 LANDIS+GYR.: OVERVIEW 57

TABLE 33 LANDIS+GYR.: STRATEGIC SNAPSHOT 58

TABLE 34 LANDIS+GYR.: BUSINESS OPPORTUNITIES AND OUTLOOK 58

TABLE 35 LANDIS+GYR.: OPERATIONAL SNAPSHOT 59

TABLE 36 LANDIS+GYR.: PRODUCT/SERVICE PORTFOLIO 59

TABLE 37 SWOT ANALYSIS 60

TABLE 38 NEPTUNE TECHNOLOGY GROUP INC: OVERVIEW 64

TABLE 39 NEPTUNE TECHNOLOGY GROUP INC: STRATEGIC SNAPSHOT 64

TABLE 40 NEPTUNE TECHNOLOGY GROUP INC: OPERATIONAL SNAPSHOT 65

TABLE 41 NEPTUNE TECHNOLOGY GROUP INC: PRODUCT/SERVICE PORTFOLIO 65

TABLE 42 ARAD GROUP: OVERVIEW 65

TABLE 43 ARAD GROUP: STRATEGIC SNAPSHOT 66

TABLE 44 ARAD GROUP: OPERATIONAL SNAPSHOT 67

TABLE 45 ARAD GROUP: PRODUCT/SERVICE PORTFOLIO 67

TABLE 46 DIEHL STIFTUNG & CO. KG: OVERVIEW 67

TABLE 47 DIEHL STIFTUNG & CO. KG: STRATEGIC SNAPSHOT 68

TABLE 48 DIEHL STIFTUNG & CO. KG: BUSINESS OPPORTUNITIES AND OUTLOOK 69

TABLE 49 DIEHL STIFTUNG & CO. KG: OPERATIONAL SNAPSHOT 69

TABLE 50 DIEHL STIFTUNG & CO. KG: PRODUCT/SERVICE PORTFOLIO 69

TABLE 51 HUBBELL (ACLARA TECHNOLOGIES LLC.): OVERVIEW 69

TABLE 52 HUBBELL (ACLARA TECHNOLOGIES LLC.): STRATEGIC SNAPSHOT 70

TABLE 53 HUBBELL (ACLARA TECHNOLOGIES LLC.): OPERATIONAL SNAPSHOT 70

TABLE 54 HUBBELL (ACLARA TECHNOLOGIES LLC.): PRODUCT/SERVICE PORTFOLIO 71

TABLE 55 MUELLER WATER PRODUCTS, INC.: OVERVIEW 71

TABLE 56 MUELLER WATER PRODUCTS, INC.: PRODUCT/SERVICE PORTFOLIO 72

Research Framework

Infoholic Research works on a holistic 360° approach in order to deliver high quality, validated and reliable information in our market reports. The Market estimation and forecasting involves following steps:

- Data Collation (Primary & Secondary)

- In-house Estimation (Based on proprietary data bases and Models)

- Market Triangulation

- Forecasting

Market related information is congregated from both primary and secondary sources.

Primary sources

Involved participants from all global stakeholders such as Solution providers, service providers, Industry associations, thought leaders etc. across levels such as CXOs, VPs and managers. Plus, our in-house industry experts having decades of industry experience contribute their consulting and advisory services.

Secondary sources

Drivers Kamstrup A/s Automotive

Include public sources such as regulatory frameworks, government IT spending, government demographic indicators, industry association statistics, and company publications along with paid sources such as Factiva, OneSource, Bloomberg among others.